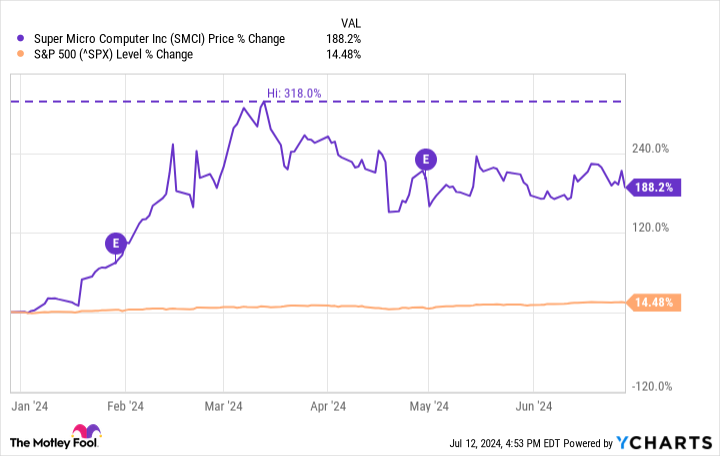

Shares of computing company Super Micro Computer (NASDAQ: SMCI) had a super, massive 188.2% gain in the first half of 2024, according to data provided by S&P Global Market Intelligence. That’s incredible enough. But by March, the stock was already up more than 300% year to date, which dwarfs its first-half returns by comparison.

Put another way, Super Micro Computer stock is down more than 20% from its 2024 high. So, depending on when investors bought shares, they’re either really happy or a little disappointed.

SMCI Chart

Super Micro Computer’s management gave a business update on Jan. 18 that got things rolling. And it followed it up with a positive financial report for its fiscal second quarter of 2024 on Jan. 29.

Before the year started, the company said that it would generate net sales of about $2.8 billion in Q2. But in January’s update, management said it would have Q2 net sales of at least $3.6 billion. It ultimately wound up with net sales of $3.65 billion — the magnitude of this outperformance is unbelievable.

For perspective, Super Micro Computer’s Q2 net sales were up 103% year over year and roughly 30% ahead of its original guidance for the quarter. The company’s products are in hot demand right now because they’re useful for building infrastructure for artificial intelligence (AI).

With booming sales, Super Micro Computer’s profits are also soaring. In Q2, it had earnings per share (EPS) of $5.10, which were up 62% from the prior-year period.

Looking at the sales boom and the profitability, S&P Global decided to add Super Micro Computer to the S&P 500 on March 1. This was another catalyst for the stock. It became effective on March 18, which is about when the stock peaked.

Why did Super Micro Computer stock slip?

Growth continued accelerating for Super Micro Computer in its fiscal third quarter of 2024 as well. On April 30, the company reported Q3 net sales of $3.85 billion, which were up 200% year over year. But believe it or not, too much growth can have its challenges.

Super Micro Computer’s growth has been so sudden and intense that there are some cash-flow issues. On March 19, the company decided to do a secondary stock offering to raise money to build inventory and expand manufacturing. This is after it raised $1.5 billion in February by issuing convertible notes.

It’s not necessarily a bad thing. But offering shares did cause it to slip from highs.

What now?

For the year, Super Micro Computer expects net sales of at least $14.7 billion — more than double its net sales in fiscal 2023. Clearly demand remains for its products.

How long will demand last? Given that it’s building up the business now with its new cash, Super Micro Computer believes things are just getting started. If management is right, there could be more good times ahead for shareholders, even if it’s not quite as good as the first half of 2024.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Super Micro Computer Stock Had a Super Massive 188% Gain in the 1st Half of 2024 was originally published by The Motley Fool