When everyone from your barber to your mailman to your financial advisor is talking about a stock, it’s probably time to consider alternatives. This seems to be the case with Nvidia, whose stock has risen an incredible 500% over the past three years. Nvidia is a terrific company and will have a long, prosperous future. But here are four lesser-known artificial intelligence (AI) companies for investors looking to add flavor to their portfolio.

Evolv Technologies

Security at schools, sporting events and concerts, hospitals, and other gatherings is a top priority, given the rise of mass shooting incidents. It’s an unfortunate fact of life these days. Traditional security consists of metal detectors and secondary screenings with wands. This model is inefficient for several reasons. Among them are benign objects like keys and wallets setting off the detectors; plus, people must go through them single file, creating huge lines. Evolv Technologies (NASDAQ: EVLV) uses artificial intelligence to create a solution.

Evolv’s sensors look similar to metal detectors, but they use AI to detect weapons based on shape and other characteristics. They don’t alert for benign metal objects, and multiple people can walk in at once. You may have experienced them and not even realized it. I noticed this technology was in place when I recently saw the Vegas Golden Knights play at T-Mobile Arena. New York City is now testing the tech on subways after a rash of violence. Overall, 800 schools, 300 hospitals, and 40 pro sports teams use Evolv.

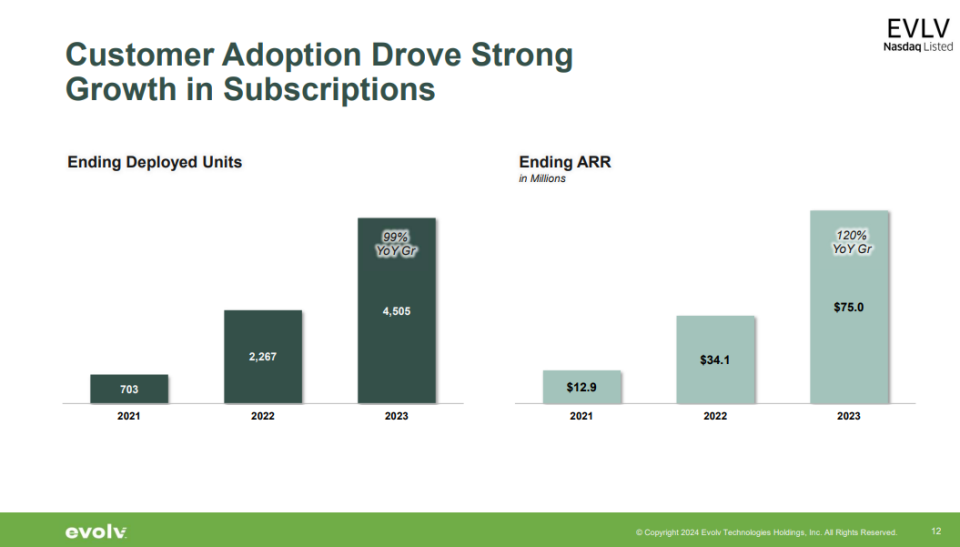

Evolv provides the software for the detectors, so most revenue is recurring, a terrific long-term business model. Customer accumulation is another significant step for Evolv right now, and the numbers are excellent, as you can see below.

Image source: Evolv Technologies.

Evolv has a market cap of $600 million, with $75 million in annual recurring revenue (ARR). Because it is a small, high-growth company, it is a speculative stock. This means it will be volatile and riskier than large, established companies. Don’t bet the farm on speculative stocks. Instead, take a nibble now and then if you see potential.

UiPath

The business world is more competitive than ever, and efficiency is critical to beating the competition. This means automating repetitive tasks that aren’t value-added. Robotic process automation (RPA) companies like UiPath (NYSE: PATH) provide the tools to do just that.

RPA mimics a repetitive process normally completed by a human using software. A simple example is data entry, but customer engagement, call center efficiency, and automated bidding are also use cases. The implication for operational efficiency is clear.

UiPath reports close to 11,000 customers and $1.5 billion ARR. Total revenue was $1.3 billion in fiscal year 2024, with 24% growth, which accelerated to 31% in the fourth quarter ended Jan. 31. UiPath guided for tepid 18% ARR growth in fiscal 2025, and the stock reflects this, trading for 8.5 times sales (considerably lower than other growing software companies). Conditions are ripe for management to beat these numbers, and that could lead to gains for shareholders.

Arm Holdings

Arm Holdings (NASDAQ: ARM) has been in the news recently, so the secret is leaking out. Still, this is a company that tech investors should know. Arm is a semiconductor (“chip”) industry leader, but it doesn’t make chips. Arm designs the infrastructure (Arm calls it the “architecture”) of advanced chips that other companies customize and build. Arm then receives a royalty and license fee for each chip sold.

Arm’s reach is enormous — its tech is used in 99% of smartphones, and 280 billion chips using its architecture have been sold to date. Two things intrigue me most about Arm: free cash flow (FCF) and stacked recurring revenue.

As I said, Arm doesn’t make the chips. This means it doesn’t have massive infrastructure costs for factories, raw materials, labor, and overhead like manufacturing companies, and that means more cash in its pockets. Each dollar of revenue produces $0.30 of FCF, allowing it to grow long-term debt-free with $3.6 billion in current assets against $866 million in current liabilities.

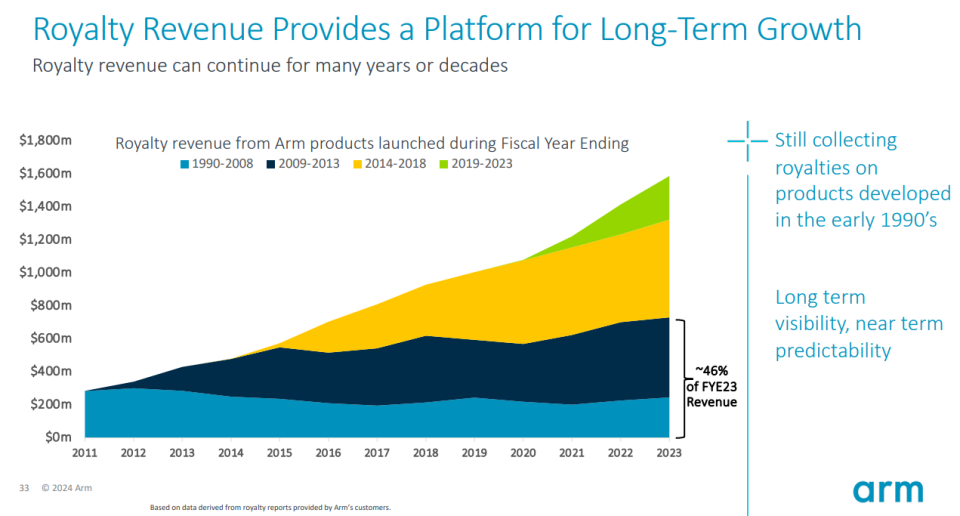

When Arm launches a new product, products produced for other applications still make money, as depicted below.

Image source: Arm Holdings.

These legacy products are extremely profitable since the development costs happened long ago. Meanwhile, new sales streams stack up.

Arm is difficult to value because there aren’t any good comparables, and it has only been public for a short time. For this reason, dollar-cost averaging is a terrific strategy for interested investors.

Amazon

Of course, we all know Amazon (NASDAQ: AMZN). It is one of the most recognizable brands on Earth. However, you may not know its huge potential in AI. AI applications, like generative AI, require colossal amounts of data moving at lightning speed. Cloud service providers like Amazon Web Services (AWS) are crucial.

Amazon released first-quarter results on April 30, and Amazon Web Services (AWS) shined with $25 billion in sales on 17% year-over-year growth. This is a significant acceleration over the 13% growth in Q4. When other companies budget more for data to utilize AI, AWS will benefit.

Foundational models (FMs) are generative AI applications, such as chatbots, that companies can customize to fit their needs. Amazon Bedrock is such a service. Customers can choose from several FMs and run them on AWS. Amazon is also developing its own chips to accelerate AI applications.

After its recent rise, Amazon stock is trading at its five-year average P/S ratio, but sales and profits are growing, so it is still an excellent long-term investment.

The tech industry is as diverse as ever, which is excellent for investors. The companies above are a diverse group on which investors should keep a close eye.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon, Evolv Technologies, Nvidia, and UiPath. The Motley Fool has positions in and recommends Amazon, Nvidia, and UiPath. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.

Top 4 “Secret” Artificial Intelligence (AI) Stocks You Should Know was originally published by The Motley Fool

:quality(85):upscale()/2024/11/13/790/n/1922564/c0ad2b806734e8c87b1ee9.61099793_.jpg)