Amid the stock split talk, investors need to keep Microsoft (NASDAQ: MSFT) in mind. The current price of around $460 per share is well below the nominal prices at which stocks like Broadcom or Nvidia recently announced splits.

Admittedly, it might be presumptuous to say that Microsoft is the next stock split. Many stocks are soaring to very high triple-digit prices amid an improving economy and game-changing market shifts in the tech sector. However, Microsoft differs from these names in one key area, which could prompt a split sooner rather than later.

Why Microsoft may split soon

Put simply, Microsoft may split soon because it is one of the 30 stocks that make up the Dow Jones Industrial Average. Unlike the other major indexes, the Dow is a price-weighted index. This means stocks with high nominal prices have disproportionate sway over the index score.

Admittedly, the index’s price-weighting approach remains controversial. So far, Berkshire Hathaway has allowed its shares to maintain a very high price rather than seek inclusion in the Dow. Nonetheless, other companies like Microsoft value being a Dow component and will probably bow to pressure to split its stock to maintain that status.

That pressure could come soon as it is among the highest-priced stocks in the Dow 30. It closely approximates Goldman Sachs’s current price and is close in price to UnitedHealth Group, which sells at around $505 per share right now.

Additionally, investors may recall that Dow component Apple initiated a 4-for-1 stock split in August 2020 when its pre-split price was close to $500 per share. Thus, it should not surprise anyone if Microsoft were to announce a stock split in short order.

The growth of Microsoft

Investors should also remember that Microsoft is, ultimately, a stock split candidate because of its underlying business growth. The company’s paradigm shifted after Satya Nadella became CEO in February 2014.

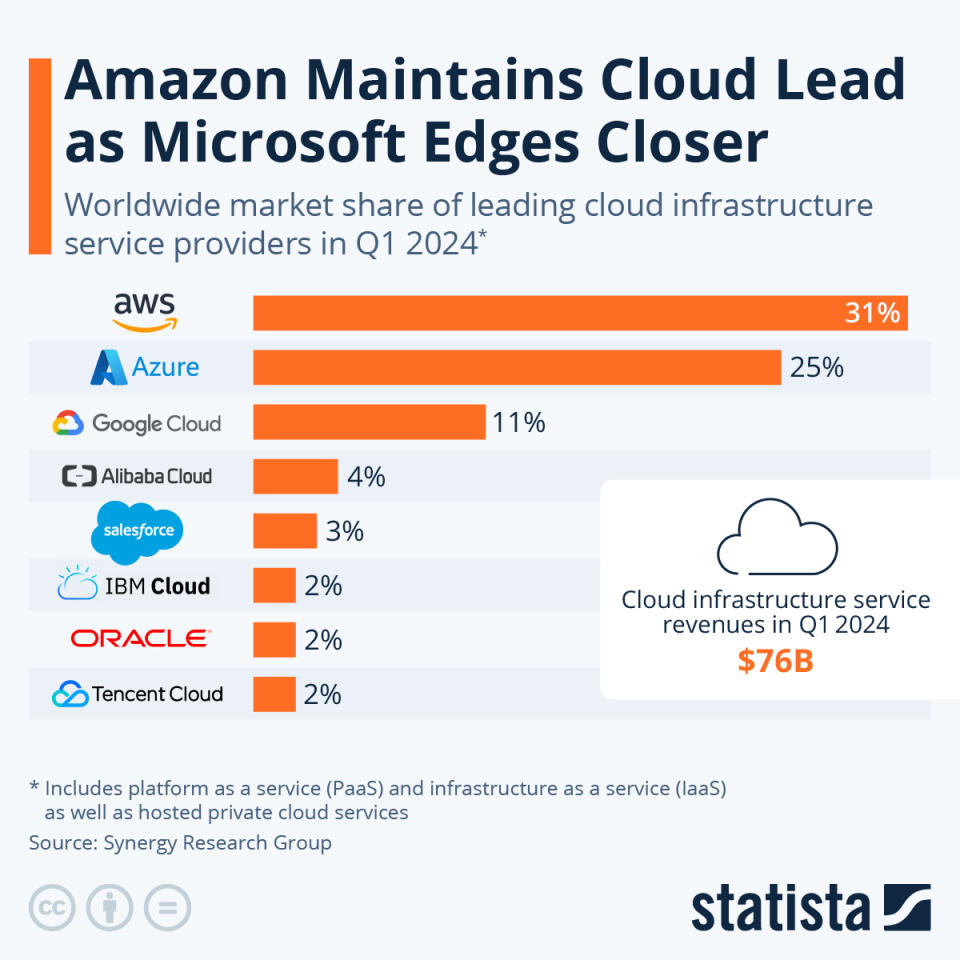

Nadella’s most notable accomplishment was making Microsoft more of a cloud-oriented business, shifting its software products to the cloud and making them mobile-friendly. Under Nadella’s leadership, Microsoft’s Azure became the second-most popular cloud infrastructure platform, lagging behind only Amazon’s Amazon Web Services, which pioneered the industry.

Image source: Statista.

Also, Nadella made Microsoft more artificial intelligence (AI)-oriented. The company partnered with OpenAI to link its search engine to ChatGPT. Through this, it launched Copilot, a chatbot powered by generative AI. This partnership also linked ChatGPT with its Bing search engine, making Microsoft a credible competitive threat to Alphabet’s search business.

As a result, Microsoft’s market cap has grown to over $3.4 trillion, making it one of the world’s largest publicly traded companies. Given that the cloud and AI will probably continue growing for years to come, the company’s growth would eventually make a split necessary, even without the association with the Dow.

The coming Microsoft stock split

Ultimately, when Microsoft will next split its stock is unclear, but a split is likely coming soon.

Admittedly, its position as one of the Dow 30 stocks is likely to hasten a split. Allowing Microsoft’s stock price to climb much further without a softening stock split could give the software giant an uncomfortably strong influence over the popular market index. However, investors should probably credit the company’s tech-driven growth for making the split necessary in the first place.

Under Nadella, Microsoft is back on the cutting edge of tech and has positioned itself as a major force in the cloud and AI industries. Such industry leadership should keep its stock growing, making an eventual split likely with or without any Dow-related pressure.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Healy has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Goldman Sachs Group, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Stock-Split Watch: Is Microsoft Next? was originally published by The Motley Fool

:quality(85):upscale()/2024/11/13/919/n/1922564/cc0839716735141c6dab05.65024797_.jpg)

:quality(85):upscale()/2024/11/13/790/n/1922564/c0ad2b806734e8c87b1ee9.61099793_.jpg)