Nvidia’s (NASDAQ: NVDA) recent stock split may have been one of the most anticipated events on investors’ financial calendars. On June 7, the company completed its 10-for-1 stock split, and the stock will begin trading at the split-adjusted price on Monday, June 10. A stock split involves issuing more shares to current holders to bring down the price of a stock that’s reached high levels. This doesn’t change the overall market value of a company or a stock’s valuation, but only the per-share price.

Since stock splits are purely mechanical, they aren’t a reason for you to buy or sell a particular stock — and that means they aren’t known to prompt stock gains or declines. Still, it’s interesting to take a look at a stock’s path following a split, and now is the perfect time to look back at Nvidia’s performance after its past few splits.

Does history offer us clues about how Nvidia stock may perform in the coming months? Let’s find out.

Image source: Getty Images.

Nvidia’s past three stock splits

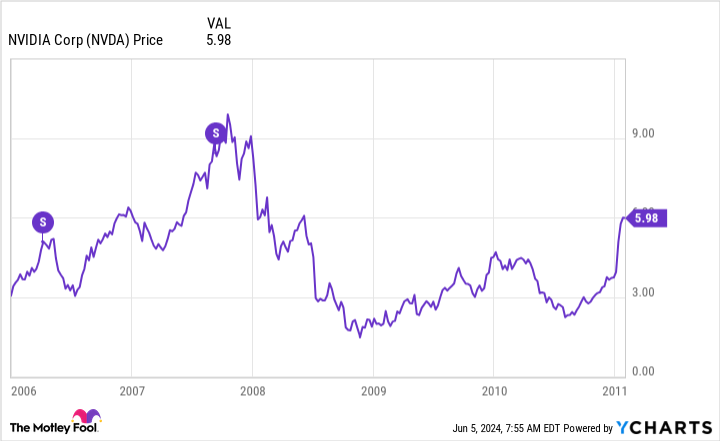

Prior to last week’s operation, Nvidia had performed a total of five stock splits over time, but we’ll consider only the past three. These happened in July of 2021, September of 2007, and April of 2006.

In the two earlier periods, the stock fell right after the split, but then went on to gain in the following months. After the 2007 split, though, Nvidia shares declined from their post-split high and spent some time trending lower.

NVDA Chart

After the next stock split, in 2021, the shares followed a similar pattern — but then, about a year later, they started picking up momentum.

NVDA Chart

And by 2023, they were roaring higher, buoyed by optimism about artificial intelligence (AI)-related revenue.

So, what does this tell us about what might happen with Nvidia shares in the months to come? It’s important to remember that Nvidia was quite a different company a few years ago, with its high-powered chips generating most of their revenue in the gaming industry.

Over the past few years, Nvidia’s sales of its graphics processing units (GPUs) to customers in the AI space have skyrocketed, and that business has soared past the gaming one. For example, in the most recent quarter, gaming revenue came in at $2.6 billion, while data center revenue topped $22 billion.

A tough comparison

This means it’s difficult to compare Nvidia’s share performance in the pre-AI-boom days to the stock performance of today. Of the charts, though, the 2021 one is the most relevant because around this time, Nvidia was seeing increasing revenue at its data center business. For example, in the first quarter of 2021, data center revenue was already climbing in the double digits.

But here’s the key element to note: The progressive gains we saw in the years following the 2021 stock split weren’t due to the stock split itself. Instead, Nvidia’s impressive revenue growth and investor optimism about its future in AI spurred the performance.

And now, as we look forward, this same element could continue to boost Nvidia’s shares. After all, we’re still in the early days of AI development, suggesting more and more companies will sign up for Nvidia’s products and services.

So, as we can see in the charts above, Nvidia’s past stock splits didn’t produce any clear pattern that may be replicated. Yes, the stock did slip post-split and then go on to gain — but these movements most likely were driven by investors locking in profits or switching in or out of Nvidia for fundamental reasons. The stock splits themselves didn’t provide direction for the stock.

Today, this confirms that the most recent stock split won’t serve as a catalyst for share performance. If Nvidia stock rises, falls, or stagnates in the coming weeks or months, we can attribute the movement to news related to earnings prospects — not to the stock split.

All of this means that today the best way to predict Nvidia’s future stock performance is to closely watch the company’s next moves — to see if it can stay ahead of rivals and dominate in the high-growth AI market.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Here’s What Happened After Nvidia’s Last 3 Stock Splits (and What That Means for the Stock Today) was originally published by The Motley Fool

:quality(85):upscale()/2025/01/15/863/n/49352476/9e69ba8767880fdc9084b2.84057222_.png)