Enterprise Products Partners (NYSE: EPD) is perhaps best known for its steady, consistent results and attractive distribution payout.

The pipeline operator has been a model of consistency over the years, growing its distribution each year for the past 25 years regardless of energy prices and economic cycles. The stock carries a 7.3% yield, which is an attractive payout for investors looking for income.

With its first-quarter results, Enterprise once again showed the steadiness of its business model. However, the company is set to go into growth mode, which should excite investors even more.

Solid Q1 results

Enterprise once again turned in solid results when it reported its first-quarter results, as its total gross operating profit rose 7% to $2.5 billion. Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), meanwhile, rose 6% to nearly $2.5 billion.

It generated distributable cash flow of $1.9 billion, and its adjusted free cash flow was over $1.0 billion. Based on its distributable cash flow, it had a distribution coverage ratio of 1.7x after increasing its quarterly distribution by 5% to 51.5 cents per unit. Enterprise ended the quarter with leverage of 3x. It defines leverage as net debt adjusted for equity credit in junior subordinated notes (hybrids) divided by adjusted EBITDA.

What this means for investors in simpler terms is that Enterprise’s distribution payout is well covered by its cash flow. The company is also in solid financial shape concerning its debt load. Combined, this means that the safety level of Enterprise’s distribution is high, as is the likelihood of the company continuing to increase the distribution.

It also gives the company the opportunity to direct that cash flow more toward new growth projects.

Image source: Getty Images.

Entering growth mode

Coming out of the pandemic, Enterprise slowed down its spending on growth projects. Prior to the COVID-19 pandemic in 2019, the company spent $4.3 billion on growth projects. That was down to only $1.4 billion in 2022.

Last year, Enterprise picked up its growth capital expenditures to $3.5 billion. These projects take time to be built and ramp up, so they didn’t have a big impact in 2023, but will show up more this year.

The company also currently plans to spend between $3.25 billion and $3.75 billion on growth projects in both 2024 and 2025. It currently has $6.9 billion in projects that are under construction. Most of these projects are set to go online sometime in 2025 or beyond.

Enterprise has averaged about a 13% return on invested capital over the past five years. That means that if the company spends $3.5 billion on growth projects, it should lead to around $455 million in additional annual gross operating profit.

The most exciting thing on the growth front for Enterprise, though, is that last month it received a deepwater port license for its proposed Sea Port Oil Terminal (SPOT) project. The company has been working over five years to get this license.

SPOT is an offshore terminal that will be able to load 2 million barrels per day of crude oil. It will be connected to the company’s ECHO terminal and other midstream assetsl. Enterprise still needs to contract out the project before making a final investment decision, but if completed, it would help make Enterprise a major player in crude exports.

SPOT is a large project that will take about three years to construct once the company decides to go forward with it. While the large project itself should get a solid return, the big benefit is that it makes Enterprise’s entire integrated crude system more valuable. It would do this in a few ways. One is that it should bring more volumes to its systems, which will also give it other pipeline and storage project opportunities. SPOT also gives Enterprise’s customers another outlet for their crude production, which should provide it additional marketing and arbitrage opportunities as well.

All this should lead to continued strong growth for Enterprise in the years ahead.

An attractive valuation

Enterprise has long been one of the best-run midstream companies out there, as evidenced by its strong distribution increase track record. That part of the Enterprise story remains, but now investors should see more growth starting to come out of the company over the next several years.

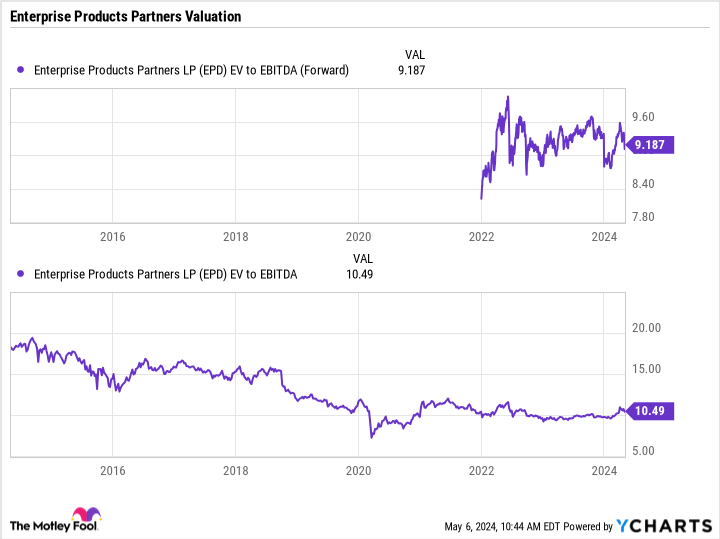

The company trades at a forward-enterprise-value-to-adjusted-EBITDA multiple of just over 9x. This compares to a trailing EV/EBITDA multiple of over 15x before the pandemic. An EV/EBITDA multiple is one of the most common ways to value midstream companies as it takes into consideration their debt levels and takes out noncash depreciation.

EPD EV to EBITDA (Forward) Chart

Enterprise is trading at very attractive levels compared to its historical valuation while at the same time ramping up growth. This is a great time for dividend investors to buy the stock.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Geoffrey Seiler has positions in Enterprise Products Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Enterprise Products Partners Is Set to Enter Growth Mode. Is It Time to Buy This Dividend Stock With a 7.3% Yield? was originally published by The Motley Fool

:quality(85):upscale()/2025/01/15/863/n/49352476/9e69ba8767880fdc9084b2.84057222_.png)

:quality(85):upscale()/2025/01/15/049/n/1922564/a753b85967884eaf8fe5f9.34920179_.jpg)