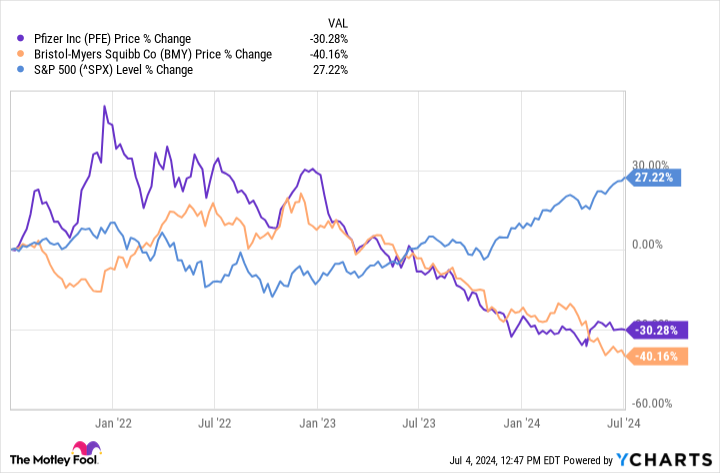

Few pharmaceutical companies are more prominent than Pfizer (NYSE: PFE) and Bristol Myers Squibb (NYSE: BMY). However, their popularity relative to most of their peers hasn’t helped them much in the past few years: Both drugmakers have substantially lagged the market. Pfizer and Bristol Myers have had their share of troubles, but there is plenty to like about both stocks, at least for investors with an investment horizon spanning five years or more. Read on to find out why both stocks are worth buying this month.

PFE Chart

1. Pfizer

The market overreacted to Pfizer’s initial success in the COVID-19 vaccine market. The company’s shares rose too much, too fast in late 2020 and 2021. However, now that Pfizer’s coronavirus-related sales have fallen off a cliff, perhaps the market is overreacting again, but in the opposite direction. The company’s shares continue to fall despite the drugmaker’s improving prospects. Pfizer has given its lineup and pipeline a major makeover in the past few years.

Brand-new approvals are coming in faster than for any of its similarly sized peers, and thanks to a string of acquisitions, Pfizer now features a deep and diversified portfolio of clinical assets.

Pfizer made a move to be more prominent in oncology thanks to its buyout of cancer specialist Seagem for $43 billion. Management plans to have eight blockbusters in this area by 2030. The pharma giant currently has five, but some are seeing their sales drop. So, Pfizer plans to develop and market more than three billion-dollar cancer medicines by the end of the decade.

Elsewhere, the company is partnering up with BioNTech — with which it collaborated on marketing a COVID-19 vaccine — to develop more mRNA-based products, including a potential combination COVID/flu vaccine that is in late-stage studies. Another partnership Pfizer entered, this time with a Massachusetts-based, biotech-focused venture capital company called Flagship Pioneering, will first target the exciting and fast-growing weight loss area.

Many of Pfizer’s moves in the past few years wouldn’t have happened without its success in the coronavirus market. Given the depth of its pipeline, the company will continue earning significant clinical and regulatory wins. Though the near term might look shaky, Pfizer can turn things around and deliver excellent returns to patient investors. It’s a great stock for long-term investors, especially at current levels.

2. Bristol Myers Squibb

Bristol Myers’ revenue hasn’t been growing fast in recent quarters. To make matters worse, the company’s top-selling medicines, anticoagulant Eliquis and cancer drug Opdivo, are flying toward patent cliffs by the end of the decade. If things aren’t that good for the company now, how will things be when its two biggest moneymakers start facing cheaper competition? That’s why Bristol Myers’ shares are lagging the market. But that’s not the whole story.

Bristol Myers remains a deeply innovative company, particularly (though not exclusively) in oncology. The drugmaker has earned a number of new approvals in recent years — since 2019 or so — that are slowly but surely rising in prominence.

Two of Bristol Myers’ newer medicines are Reblozyl, a therapy to treat anemia in beta thalassemia (a rare blood disease) patients, and the cancer drug Opdualag. The former earned the green light in the U.S. in 2019, with the latter getting the nod in 2022. Both are generating reasonably strong sales. In 2023, Reblozyl’s revenue came in at $1 billion, 41% higher than the previous year. Opdualag’s sales of $627 million jumped by almost 149% year over year.

Furthermore, these and Bristol Myers’ other new medicines should earn important label expansions and boost the company’s top-line growth. Bristol Myers’ pipeline will help it produce new gems as well. The company’s revenue will decline, at least for a few quarters, once it hits significant patent cliffs at the end of the decade. But developing brand-new medicines is the answer to that problem, and that’s exactly what Bristol Myers has done in the past, is doing now, and will continue to do. It’s a great idea to pick up the company’s shares on the dip.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $780,654!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb and Pfizer. The Motley Fool recommends BioNTech Se. The Motley Fool has a disclosure policy.

2 Pharma Stocks to Buy Hand Over Fist This Month was originally published by The Motley Fool

:quality(85):upscale()/2024/11/13/919/n/1922564/cc0839716735141c6dab05.65024797_.jpg)

:quality(85):upscale()/2024/11/13/790/n/1922564/c0ad2b806734e8c87b1ee9.61099793_.jpg)

![Finesse2Tymes & Og Boo Dirty – Real Recognize Real [Official Music Video] Finesse2Tymes & Og Boo Dirty – Real Recognize Real [Official Music Video]](https://i.ytimg.com/vi/3xb4bl5PWF8/maxresdefault.jpg)