Bit by bit, Western companies and governments are reassembling their rare earths supply chain, trying to reverse decades of the hollowing out, outsourcing, and offshoring of the critical industry to China.

No one said this would be easy.

Read more

This month brought a promising development: new investment in a Norwegian rare earths processing firm. It’s a vital cog in the eventual establishment of a transatlantic supply chain spanning Canada, Sweden, and Norway.

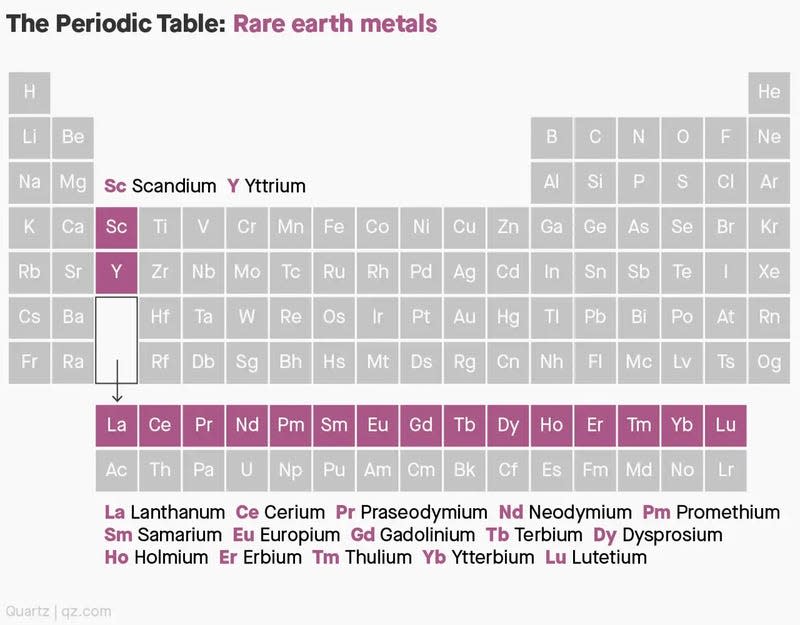

If successful, the initiative will help the West chip away at its near-total reliance on China for rare earths, a group of 17 metals that are critical for manufacturing high-tech products. China currently accounts for 60% and 87% of global rare earths mining and processing, respectively—a degree of dominance over a critical sector that Western governments deem an acute threat to their national security.

“A…Nordic value chain for rare earth metals”

The Swedish state-owned iron ore mining company LKAB announced this month that it has become the main investor in and owner of REEtec, a Norwegian firm. Since its founding in 2008, REEtec has been developing technology to separate rare earths from impurities and refine them into high-quality, high-purity materials, known as rare earth oxides, for use in products like electric vehicle motors and wind turbines.

LKAB’s 400 million kroner ($40.3 million) investment will help REEtec finance a substantial portion of its rare earths separation factory in the Norwegian industrial peninsula of Herøya, where production is slated to begin in 2024.

“Together with REEtec, we will create the base for a strong and sustainable Nordic value chain for rare earth metals,” Jan Moström, the CEO of LKAB, said in a statement.

This isn’t the first such transatlantic supply chain to take shape. Last year, two North American companies announced a partnership to establish a US-Europe supply chain running from the desert plateaus of Utah, in the US, to the small coastal town of Sillamäe in Estonia.

To run its factory, REEtec will source its raw material, known as rare earth carbonate, from Canada’s Northwest Territories. There, a company called Vital Metals is mining rare earth ores at its Nechalacho project, then performing some preliminary processing at a nearby facility. Under what’s known as an offtake agreement, REEtec will buy the rare earth carbonate from Vital Metals, to then bring to the forthcoming REEtec separation plant for further refining.

LKAB, Europe’s largest iron ore producer, will also supply REEtec with raw material from 2027. That feedstock will be extracted as a byproduct of LKAB’s iron ore mining in Sweden—a business model that China has used to great success.

“I like this very much, the approach with the byproduct, because you don’t need to establish a new mine,” said Per Kalvig, a senior researcher at the Geological Survey of Denmark and Greenland’s Center for Minerals and Materials. “And second, with reduced capital costs, you’re less vulnerable to the competition from China, because it’s an add-on production.”

LKAB did not respond to a request for comment.

Removing China from one segment of the supply chain

The incipient Canada-Sweden-Norway supply chain is also important for another strategic reason: Vital Metals’ Nechalacho mine will not be dependent on Chinese buyers.

That sets it apart from the only other commercially active rare earths mine in North America—MP Materials’ Mountain Pass mine in California—which sells almost all of its mined rare earths to its Chinese minority stakeholder, the partially state-owned company Shenghe Resources. According to MP’s latest filings (pdf), Shenghe accounted for over 94% of MP’s total revenues in the first three quarters of 2022.

“[Nechalacho] is the only rare earths mine in North America that doesn’t supply China,” David Connelly, vice president of strategy and corporate affairs at Vital Metals and its mining subsidiary Cheetah Resources, told the Canadian Press in May.

Periodic table, with rare earth elements highlighted

It’s also a comeback story for the Nechalacho mine. For years, the mine lay undeveloped after the rare earths bubble burst in 2011, leaving its Canada-listed owner Avalon Advanced Materials without the financing needed for the project. It wasn’t until 2019 that Cheetah Resources struck a deal to buy the near-surface portion of the Nechalacho mine from Avalon. Vital Metals finally restarted mining operations at Nechalacho in 2021.

“This deal is significant because you now see a mineral prospect in Canada that for many years was seen as an orphan, and is now going into operation” and seeding the supply chain in Europe, said Kingsley Jones, CIO and founding partner at Jevons Global in Australia.

The challenge: China’s monopoly and monopsony power

Even if a non-Chinese firm is buying up Vital Metals’s raw rare earths, the next stage of the supply chain—companies who will buy the refined rare earths to use in manufacturing—is still likely entangled with and dependent on China.

That’s because China has established itself as both a dominant seller and buyer of rare earths, giving it sweeping influence over the entire global rare earth industry. Merely extracting more rare earths outside China isn’t enough to reduce total reliance on China for the metals.

What’s unique about the rare earth industry is “the presence of China at every stage as both a monopoly and a monopsony…which makes it very difficult [for other countries] to significantly penetrate the supply chain,” said Andy Mok, a senior research fellow at the Beijing-based think tank Center for China and Globalization.

In its statement, LKAB said 80% of REEtec’s planned production of rare earth metals has already been sold. One of REEtec’s customers is the German automotive supplier Schaeffler Group. Among other products, Schaeffler makes electric vehicle motors, which require rare earth permanent magnets. But producing such magnets requires highly specialized expertise, and Schaeffler does not have a history of making them.

In an April statement announcing its deal with REEtec, Schaeffler said the partnership would “secure our supply of magnets for electric motors,” without specifying who the suppliers would be. But they’re likely to be Chinese, “given the strong connection between Schaeffler and China,” said Kalvig. Plus, China produces 93% of the world’s high-strength permanent magnets. As a result, the new transatlantic supply chain’s downstream sections are still reliant on China, even if the upstream and midstream segments are not.

Schaeffler did not respond respond to a request for comment.

Less China dependency, more supply chain transparency

Building a new rare earth supply chain requires a degree of transparency from companies about who their suppliers are—commercial information that firms are often loathe to disclose.

“If you’re Volkswagen competing with BMW, you don’t want BMW knowing where you find a particular component made to a particular specification,” said Jones. “But by the same token, you both have a common interest that you’re not held to ransom by a foreign supplier. It’s inherently complex and you’re not going to get straightforward answers.”

The US has taken steps to get some of those answers.

Last September, the US commerce department launched an investigation to determine whether imports of rare earth permanent magnets pose a threat to national security. The investigation concluded in September, with the White House deciding against tariffs and opting for increased investment in the domestic magnet industry. The probe also helped Washington gather useful information from industry players—details that can help inform broader policies and strategies.

Jones thinks Europe now needs to conduct a similar probe to wring important information out of companies. The question of where European firms are getting their magnets is “very opaque,” he said. “Because of the very close supply chain linkages between China and Germany and France…it’s hard to tell what’s going which way on the boat, and I don’t think anybody really knows.”

More from Quartz

Sign up for Quartz’s Newsletter. For the latest news, Facebook, Twitter and Instagram.

![Dax – “Soldier” (Feat. Tom MacDonald) [Official Video] Dax – “Soldier” (Feat. Tom MacDonald) [Official Video]](https://i.ytimg.com/vi/PYQqe27R2L0/hqdefault.jpg)