Despite a rocky start in August, investor sentiment has remained resilient, with the S&P 500 rallying nearly 9% since its August 5th low.

This upward momentum has been driven by a series of positive economic data releases, including better-than-expected initial jobless claims and strong retail sales figures.

Wall Street also reacted favorably to Federal Reserve Chair Jerome Powell’s comments on Friday, signaling that the Fed is prepared to cut interest rates as the labor market softens and inflation approaches the Fed’s 2% annual target.

With this bullish surge in play, the key question is: how can you spot the next hot stock in this environment? One effective strategy is to focus on high-upside stocks endorsed by analysts from top-tier investment banks like Morgan Stanley. These experts bring valuable experience and in-depth knowledge to the table.

In fact, the analysts at Morgan Stanley have highlighted two stocks they believe are poised for significant gains in the coming year – with potential upside as high as 220% in one case. If that’s not enticing enough, according to the TipRanks database, both stocks are also rated as Strong Buys by the analyst consensus. Let’s see what’s driving the unanimous praise from analysts.

COMPASS Pathways (CMPS)

The first Morgan Stanley pick we’ll look at is COMPASS Pathways, a biopharma firm developing innovative treatments for hard-to-treat mental health disorders by leveraging the psychedelic effect of psilocybin. As the active compound in ‘magic mushrooms,’ psilocybin has garnered attention in psychiatric circles for its potential to effectively treat a wide range of mental health conditions.

COMPASS has developed a synthetic psilocybin formulation, known as COMP360, designed to be used in conjunction with psychological support and therapy. The treatment process involves an initial series of sessions where the patient and therapist build rapport, followed by controlled drug administration sessions where the patient receives psilocybin. During these sessions, the patient is closely monitored, and post-session discussions with the therapist help process the experience.

Currently, COMPASS’s most advanced trial program focuses on using psilocybin to treat patients with treatment-resistant depression (TRD), a severe mental health condition that significantly diminishes quality of life. The company is investigating the COMP360 treatment in two Phase 3 clinical trials (COMP005 and COMP006); COMP005 is evaluating the effects of a single-dose monotherapy in 255 participants, with top-line data expected by Q4 2024 or early 2025. Meanwhile, COMP006 is focusing on fixed repeat dose monotherapy in a larger cohort of 568 participants, with top-line results anticipated by mid-2025.

In addition to this late-stage study on TRD, the company’s COMP360 treatment has also been the subject of an open-label Phase 2 study in the treatment of PTSD. The study involved 22 patients, focused on safety and tolerability, and positive results were announced during the second quarter of this year. Building on these results, the company is now evaluating the best approach to advancing its PTSD treatment.

Morgan Stanley analyst Vikram Purohit, who covers the stock, sees CMPS as presenting a compelling risk-reward opportunity. He highlights the company’s leading clinical program, stating, “Progress continues with the PhIII program for COMP360 in TRD, where the next fundamental milestone is top-line data from the PhIII COMP005 trial in 4Q24… The PhII data for COMP360 in TRD is competitive, KOL feedback on the data and uptake potential for COMP360 is positive, and the commercial opportunity in TRD is well-defined.”

“Based on the data generated & stage of development for COMP360, CMPS appears significantly undervalued and we find the risk/reward skewed positive into data catalysts in 2024/2025 that we believe could drive significant appreciation in shares,” the analyst added.

To this end, Purohit rates CMPS shares an Overweight (i.e. Buy), and his $23 price target points toward a robust one-year upside potential of ~220%. (To watch Purohit’s track record, click here)

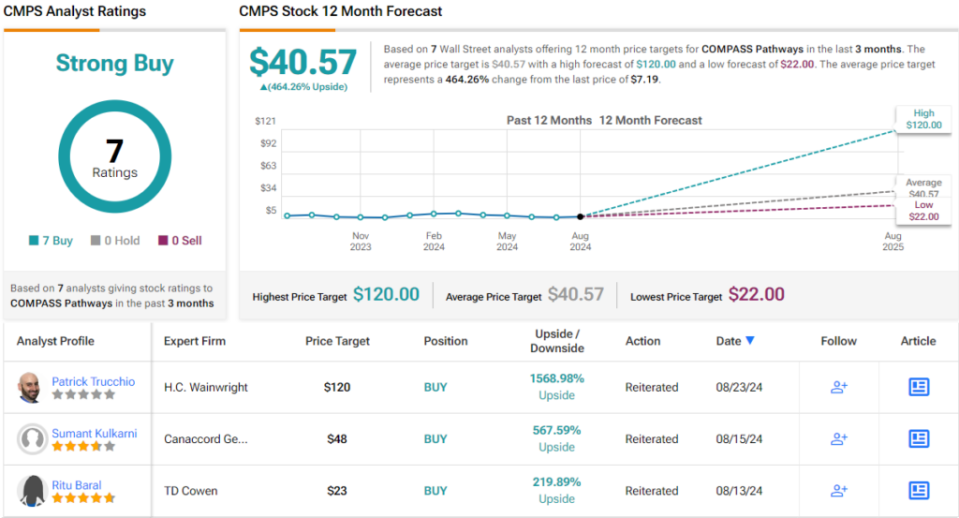

The broader analyst community shares Purohit’s optimism. Based solely on Buy recommendations – 7 in total – analysts collectively rate CMPS as a Strong Buy. With the stock currently trading at $7.19, the average price target of $40.57 implies an impressive upside potential of 464% over the next year. (See CMPS stock forecast)

Rocket Pharmaceuticals (RCKT)

Next up on Morgan Stanley’s list is Rocket Pharmaceuticals, a biotech company at the forefront of gene therapy. Rocket employs adeno-associated (AAV) and lentiviral (LVV) vectors to pioneer treatments for complex, rare hematologic and cardiovascular conditions, areas with significant unmet medical needs and limited treatment options.

Rocket’s most advanced programs focus on hematology. The company is advancing LV RP-L102, a drug candidate designed to treat Fanconi anemia, and Kresladi, a potential treatment for LAD-1.

On the Fanconi track, Rocket recently released positive data from its Phase 1/2 study and confirmed that regulatory filings remain on schedule.

Conversely, the company faced a setback in June when the FDA issued a Complete Response Letter for the Biologics License Application for Kresladi, requesting additional CMC information to complete its review. Rocket’s management has assured that the review process is ongoing and that they are actively collaborating with senior leaders and reviewers at the FDA’s Center for Biologics Evaluation and Research to resolve the issue.

On the cardiovascular front, Rocket’s research programs are progressing well. Among the most prominent candidates are PR-A501 and RP-A601. PR-A501, a potential treatment for Danon disease, is currently in a Phase 2 pivotal study, while RP-A601, targeting PKP2 arrhythmogenic cardiomyopathy, is enrolling patients for a Phase 1 study.

Rocket’s large and varied pipeline has caught the attention of Morgan Stanley analyst Michael Ulz, who is particularly impressed by the cardiovascular advancements.

“Our Overweight rating is based on Rocket’s position as a leader in the gene therapy field combined with a robust pipeline and experienced management team. We view RP-A501 (AAV) in Danon disease as a key driver with blockbuster potential and see broader potential from the cardiovascular pipeline (PKP2 and BAG3). While we expect focus on the cardiovascular pipeline, we believe the more advanced hematology (LV) franchise provides near term opportunity,” Ulz opined.

Ulz complements his Overweight (i.e. Buy) rating on RCKT with a $45 price target, implying a 142% gain for the stock in the coming 12 months. (To watch Ulz’s track record, click here)

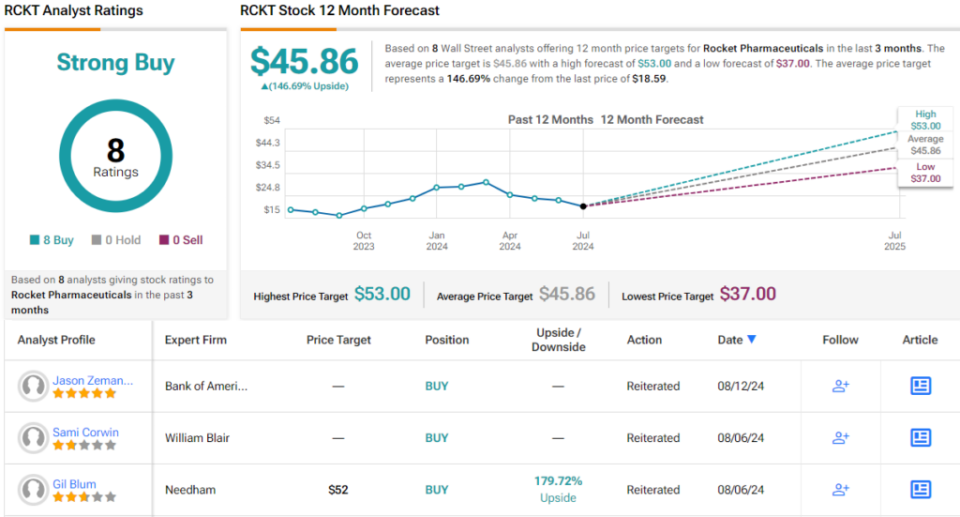

No one is arguing with that take on Wall Street. The stock’s Strong Buy consensus rating is based on Buy recommendations only – 8, in total. The forecast calls for one-year gains of ~147%, considering the average price target stands at $45.86. (See RCKT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

:quality(85):upscale()/2025/01/07/813/n/1922564/b63421d9677d72ddd6eff7.56786871_.png)

![Jordan Adetunji – KEHLANI REMIX (feat. Kehlani) [Official Video] Jordan Adetunji – KEHLANI REMIX (feat. Kehlani) [Official Video]](https://i.ytimg.com/vi/EeJ8n5PxFGE/maxresdefault.jpg)