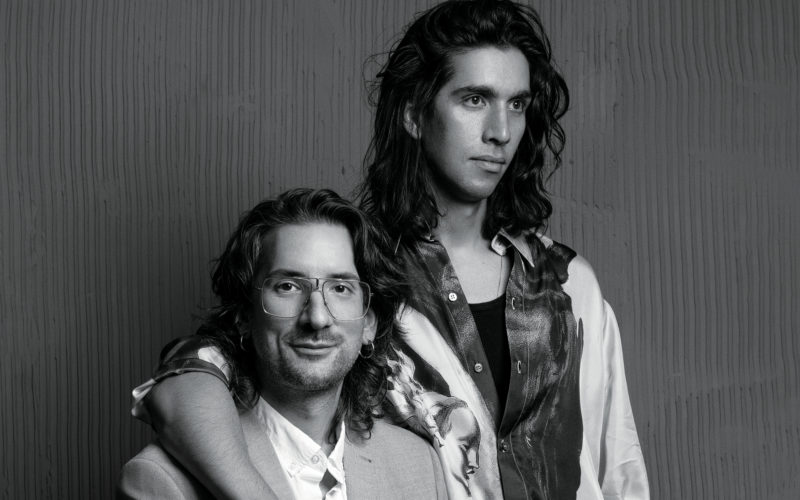

Dakin Campbell is the reporter you want to talk to when you want to understand Wall Street. He covered finance at Bloomberg News for over nine years, before moving to Insider, where he’s been covering the industry for over four years as a correspondent.

(Disclaimer: Campbell and I were colleagues for roughly two years at Insider, before I moved to Fortune.)

Earlier in his career, Campbell spent about four years in San Francisco, reporting on finance and banking for Bloomberg; so in 2019, when Insider asked him to cover the debacle that was the IPO of WeWork, the “unicorn” office-rental firm that was super-valuable in private markets and far less valuable in public markets, Campbell says he understood the mindset of both Silicon Valley and the bankers back in New York.

“I had a really interesting experience looking at banking through the eyes of my sources on the West Coast,” he told me. “As you’d expect, they look at the world very differently from the East Coast investment banks.”

His new book, Going Public, is all about the coastal rivalry that emerged between the Silicon Valley guys who say, “Why don’t you do this differently?” and the Wall Street guys who say, “Well, this is the way it’s done. We can’t do it differently.” (My words, not his.) It starts with an incredible anecdote Campbell uncovered in his reporting where Steve Jobs essentially did his own research on how West Coast guys like him were getting ripped off by bankers back East.

The story that unfolds is something that every startup founder can learn from, Campbell told me.

The following interview has been lightly edited and condensed for clarity.

I’ve been reading about IPOs for a long time in my work life, and your book is one I always wanted: the secret history of how Wall Street and Silicon Valley invented the modern process of IPOs—taking a company public. Tell me a little bit about how you got captivated by this story, especially the story that starts off the book, when Steve Jobs puts his finger on something that went on to bother tech executives for decades.

So when I started as a journalist, it was right in the middle of the financial crisis. And so I grew up in my career being really interested in diving into a corner of Wall Street to explain it for people that didn’t understand it. Back then it was mortgage bonds. Now it’s IPOs.

In the last few years, around 2018 and 2019, the WeWork IPO going off the rails really made me think there was a lot going on under the surface that I didn’t quite understand. On the back of some coverage I did for Insider, I got interested in going down the rabbit hole of how that particular deal fell apart and how the IPO market worked, but I came to learn that the entire system had been built up in a way that didn’t necessarily advantage startups and technology entrepreneurs.

I soon learned that the IPO market has a rich history, and things hadn’t always been done this way. I talked to people involved with some of the biggest IPOs of the last 100 years or so, including Ford Motor Company and Apple Computer, and Steve Jobs seemed to have seen right through the conflict of interest that has sort of come to represent the IPO market for a lot of people. I mean, Steve Jobs is sitting in a building in San Francisco’s Financial District, meeting with bankers at both Morgan Stanley, the big investment bank at the time handling tech IPOs, and Hambrecht & Quist, a much smaller sort of boutique investment bank. The Morgan Stanley bankers proceed to tell Steve Jobs how they are planning to price Apple stock, that they’ve talked to lots of investors, and they think they can price it around $18. And Steve Jobs listens, and then he says, “But hold on, I’ve been talking to people, too. And they tell me that they think I could price it for $20 to $24 or even $26.”

And the Morgan Stanley investment bankers are sort of quiet. And then they say, “Well, we think $18 is a good price.”

And he says, “Well, hold on a second, if you sell my shares of Apple to your best clients for $18, aren’t they going to be super happy when they can turn around the very next day and sell them for $24 or $26 or $28?” And in that moment, Steve Jobs, who’s obviously a brilliant designer and a brilliant business mind around hardware technology, saw right through one of Wall Street’s systems in a way that a lot of people weren’t doing. It really struck me that here’s a guy we give all this credit to for being smart in the tech realm, and lo and behold, he saw right through the investment banking playbook all the way back in 1980. And then 40 years later, that playbook sort of remained the same. That’s what the folks who show up later in my book set out to change.

Steve Jobs hits upon flaws in the IPO process in the late ’70s/early ’80s, but then it takes 40 years for the next leap forward, as becomes obvious in the book. Why did it take so long for someone to follow through on Steve Jobs’ observation?

Between 1980, when Apple goes public, and 2018, when Spotify does the first direct listing, there are obviously a lot of boom-and-bust cycles in tech stocks. And so the “first-day pops” [when a stock increases in trading to a value far above its listing price] that really bothered everybody became an issue in the late 1990s, but then the market actually corrected itself [with the dotcom bubble bursting]. Many people who lost a lot of money in the Nasdaq crash didn’t think of it in those terms, but I think if the first internet boom had continued, you might have seen the backlash that we eventually got later.

But there were no tech IPOs for a while, and then when Google went public in 2004, they really wanted to do something different. And so they designed a “Dutch auction,” and everybody thought that Google was going to become sort of this harbinger and change agent of things to come, but for various reasons it didn’t. Many people didn’t see the Google IPO or auction as a success, and that sort of squashed any sort of widespread plans to reinvent the IPO process.

But then you had the financial crisis, and coming out of that we once again started to see tech valuations soar; we started to see first-day pops become a regular occurrence.

You mentioned that reporting on WeWork got you into this subject, and it occurs to me, that is the reverse of the first-day pop. I remember when they filed their paperwork to go public, it was a huge day on Wall Street, which had been waiting for years to look at its financials, and the Street did not like what it saw, and they had to refile again and again, and ultimately went public at a much lower valuation. Do you agree with that?

Because of the particulars around that company and its founder, I think that’s a bit of a different case. In that same year, you do start seeing software companies doubling their share price on the first day. But it is true WeWork was part of a moment when a lot of people were looking at the IPO market and the IPO system being broken.

But WeWork being private for so long and raising so much money before going public is important because the innovations that I write about in my book wouldn’t have happened if the private markets had grown that way—the sheer amount of capital available to these startup companies that allowed them to avoid the public markets for many years longer than they ever had before.

Those innovations you mention are a huge part of your book. Let’s start with Google’s Dutch auction. What is that anyway?

So it’s called a Dutch auction because it’s based on the way that flowers are auctioned off in the Netherlands, which if you’ve heard of the tulip mania from hundreds of years ago [one of the most famous examples of financial speculation in history], the Dutch have been selling flowers for centuries. The way they do that is they start at a high price, and lower the price until all of the flowers are sold. Google set out to do something similar with its shares when it went public.

How about Spotify’s direct listing? That innovation came after Google’s IPO and plays a bigger part of your book.

So, very simply this is directly listing your shares on a stock exchange. In traditional IPOs, a company issues new shares and sells those to investors by listing the new shares on an exchange, but with a direct listing, the company does not issue new shares, they just take the shares that they’ve already sold to investors as a private company, and put those on the exchange. Spotify was able to do that because they did not need any money, which is the traditional reason a company goes public. Because the private markets had grown so large, Spotify was able to raise a ton of money a couple of years before they went public, and when Barry McCarthy, the CFO at the time, who is now the CEO of Peloton, was looking to go public, he wanted to find any way that he could do that without issuing new shares.

Many of Spotify’s employees and investors wanted a way to exit, but Spotify didn’t need more capital, so Barry was really trying to find a way for them to do that.

You’ve talked a lot about how the tech world thought the IPO process was broken, and the innovations intended to fix it. Without crowning you the IPO expert, did they fix what was broken? Or where does the process stand now?

So there’s some debate about this. There have only been 13 or 14 direct listings since then, including Spotify. That’s relative to hundreds of IPOs during the same period. The argument I make in my book, and I tested this out on many people who thought it was sound, is that by giving startup executives the option of going with the direct listing, they were actually able to pry more concessions out of their investment bankers, so many of the IPOs that took place after Spotify looked very different from before in that they involve more changes and flexible terms friendlier to startups than in the past. So even though a ton of companies haven’t pursued a direct listing, that sort of gave them permission to push back on their bankers and their investors.

That essentially gave leverage to all of Spotify’s startup brethren out there who were considering IPOs.

Yes, exactly. And even if the startups ultimately chose to stick with a traditional IPO, that ended up being structured much more in their favor than it would have been otherwise.

At the end of the book, you touch briefly on the SPAC boom of the pandemic, which has taken another turn since your book was published. Do you see SPACs as innovation that acts like another form of leverage in a way?

I do see them as part of that continuum. Bill Gurley, the famous venture capitalist, who I talk about quite a bit in the book, continued banging the drum for change after Barry McCarthy and Spotify. In the summer of 2020, Gurley said SPACs are a legitimate way for tech companies to go public, making the point that there was so much competition in the SPAC market at the time, that startups could extract concessions and cheaper fees from their investment bankers and their investors.

Now, the boom and the bust in SPACs that we’ve seen suggests that maybe they weren’t quite the solution that people thought they were. In my book, there are several examples of tech companies that didn’t sell to SPACs. Slack was approached by Chamath Palihapitiya about doing a SPAC early on, and Airbnb was approached by Bill Ackman to do a SPAC, and both turned those opportunities down.

That leads me to a big takeaway from many of the people I spoke to: If you are a startup executive, you have a lot more power in the IPO process than you might think. It’s your company, and it’s your idea, and so many people get into the IPO process and hand it over to people that they think are the experts, when in reality, they could become much more involved, and mold the process to their liking or to their advantage.

Right. If you’re at the IPO stage, it means you have a valuable company, and you have a lot more leverage, thanks to Barry McCarthy and Spotify and Steve Jobs and Apple, and all the people who’ve come before. I mean, I think Steve Jobs was pretty confident that regardless of the first-day pop, Apple was going to be just fine. But he knew something that other tech executives coming after him would need to know.

That’s right. He took an interest in the process in a way that a lot of tech executives don’t. Many, many CEOs or founders are more than happy to hand over the process to their CFO or to the investment bankers or other advisers that they hire. What Steve Jobs or Daniel Ek [Spotify’s cofounder and CEO], working with Barry McCarthy, will tell you is to get involved in the process and take an interest, and there will be things to learn and value to be had.

“We can go public the way people always have or we can work with our bankers to come up with something that suits our needs.“

Right. Exactly.

Well, Dakin, thank you for your time and congratulations on your book.

:quality(85):upscale()/2023/09/13/661/n/1922564/e914a1066501cc897903d6.08615338_.png)