Each week we identify names that look bearish and may present interesting investing opportunities on the short side.

Using technical analysis of the charts of those stocks, and, when appropriate, recent actions and grades from TheStreet’s Quant Ratings, we zero in on three names.

While we will not be weighing in with fundamental analysis, we hope this piece will give investors interested in stocks on the way down a good starting point to do further homework on the names.

Greenbrier Jumps the Track

Greenbrier Companies (GBX) recently was downgraded to Hold with a C rating by TheStreet’s Quant Ratings.

The maker of railroad freight cars fell sharply last week on very heavy turnover, with the big money in distribution mode. Money flow is showing a bearish reading now, while the Relative Strength Index (RSI) is bending lower at a steep angle. Moving average convergence divergence (MACD) is still on a bearish crossover signal and the cloud is just turning red.

Greenbrier’s stock has more downside potential, with the October lows in sight around $24. Target that area, but put in a stop at $30 just in case.

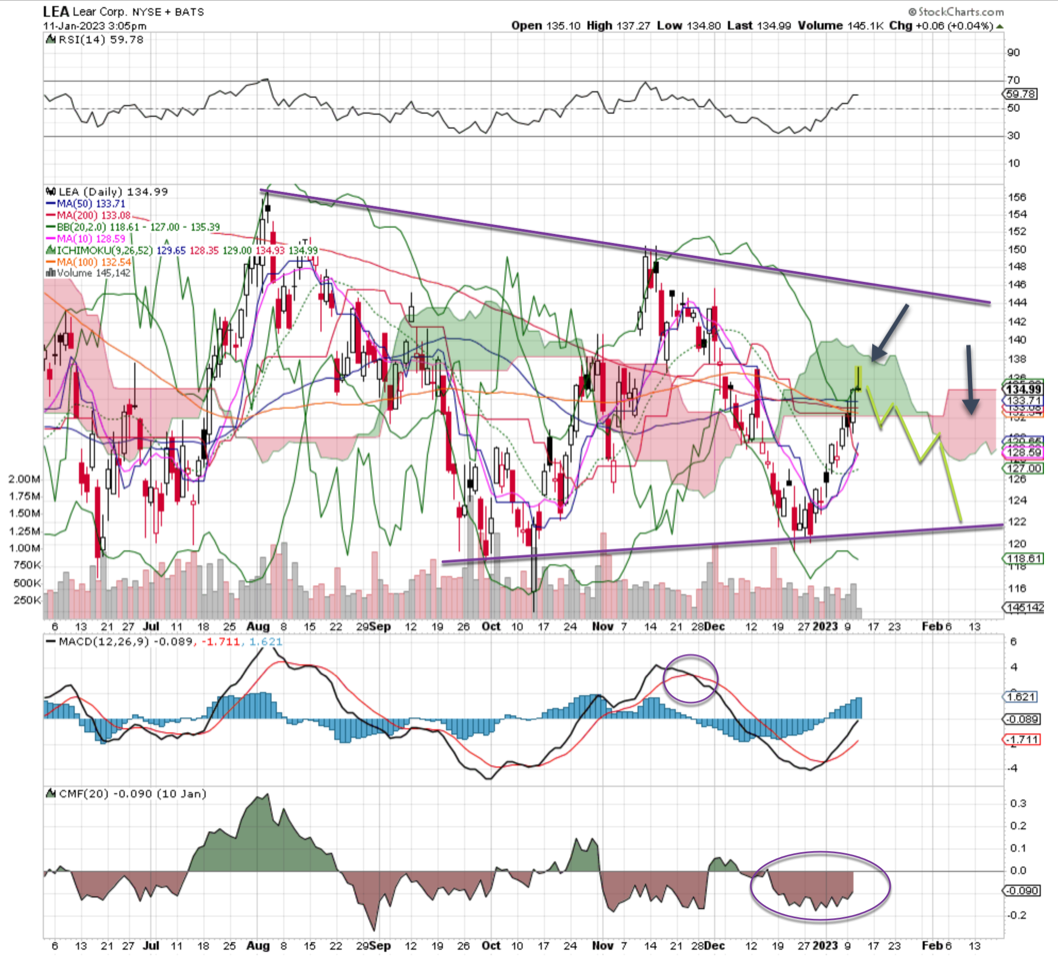

Lear Can’t Get in Gear

Lear Corp. (LEA) recently was downgraded to Hold with a C+ rating by TheStreet’s Quant Ratings.

The producer of automotive seating and electrical distribution systems has a wide range and an established low, but the stock seems to be having trouble at the 200-day moving average. That should come as no surprise. Money flow is bearish and the MACD, while turning higher, still remains on a sell signal. There is plenty of room here for Lear to go down toward the lower trend line; let’s call it $122.

Notice the bearish shooting star candle created on Wednesday. That tells us sellers are all over the stock. A swift move down to the target area is very real. Nonetheless, put in a stop at $140.

Central Garden Is Wilting

Central Garden & Pet Co. (CENT) recently was downgraded to Hold with a C+ rating by TheStreet’s Quant Ratings.

This producer of lawn and garden products and pet supplies came onto the downgrade list last week after a miserable tumble to end 2022 close to its October lows. While we have seen a bit of a bounce, there is no mistaking that this stock is in a severe downtrend.

With lower highs and lower lows Central Garden is ready for the next move downward. The cloud is red while the money flow is bearish, and the RSI shows a steep downtrend line as well. If short, target the $30 area, put in a stop at $39 just in case.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.