Billionaire investor Warren Buffett made his fortune buying shares of companies when they were on sale. If you have extra money you don’t need for paying bills or reducing debt, there are great opportunities to put that cash to work in the stock market right now. Let’s look at two stocks that could soar over the next few years.

1. Carnival

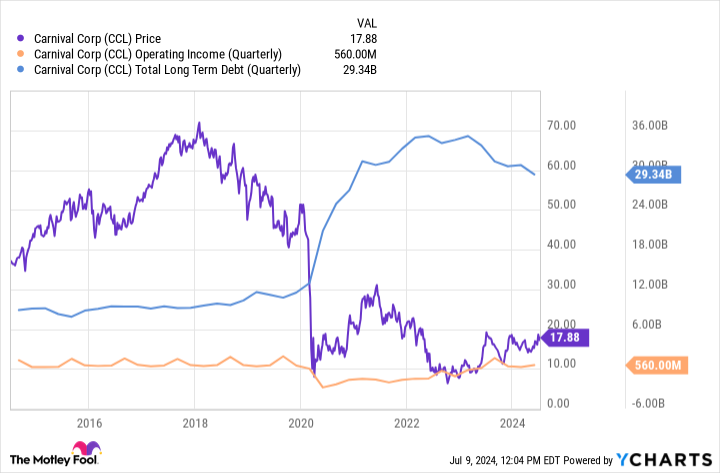

The growing travel market is a big tailwind for leading cruise line Carnival (NYSE: CCL). But despite growing revenue and operating profit, which are back to pre-pandemic levels, the stock is still trading at a huge discount. The share price is currently 76% off its previous peak, which indicates substantial upside for shareholders.

One factor holding the stock down is a substantial increase in the company’s debt, which it had to issue to fund operations during the pandemic. However, the debt should continue to come down as Carnival’s revenue and operating profit continue to grow, and this is a major catalyst for the share price.

The company’s operating income jumped to $560 million in the second quarter, up nearly 5 times over the same quarter in 2023. The improvement reflects favorable trends in pricing, demand, and operational costs. The company expects continued pricing improvements in 2025 that should support healthy margins.

CCL Chart

Looking ahead to 2025, the company is seeing “unprecedented demand,” as management noted on the last earnings call. One opportunity is next year’s launch of Celebration Key — an exclusive destination for Carnival passengers, which should drive more revenue growth and benefit investors.

The stock trades at a modest forward price-to-earnings ratio of 15, so as the company pays down debt and delivers profitable growth, Carnival stock should climb higher over the next few years.

2. Roku

Roku (NASDAQ: ROKU) is a popular streaming platform with 81 million households and growing. This is another discounted stock down 87% off its previous highs. Roku delivered record revenue and free cash flows this year, and more growth could push the stock higher over the next year.

The number of households using Roku grew 14% year over year in the first quarter. This growing base has helped Roku continue to attract advertisers to the platform, which is how it makes money. Roku’s trailing revenue has nearly doubled to $3.6 billion over the last three years, while free cash flow has tripled to $426 million.

The stock is trading at an attractive price-to-free-cash-flow multiple of 20, which seems a bit low given Roku’s double-digit growth in streaming households. One factor holding the stock back is the uncertainty with the advertising market. Wall Street might be looking for more growth in average revenue per user, which has hovered around $40.65 over the last year and remains flat.

Still, the advertising market will inevitably pick up. The more households that sign up for Roku, the more profitable growth the company will experience when the ad market is strong. Management expects accelerating platform revenue in 2025, so now’s a good time to consider buying shares before better news potentially sends the stock higher.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Roku. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

Got $1,000? 2 Stocks to Buy Now While They’re On Sale was originally published by The Motley Fool

![Moneybagg Yo – PLAY DA FOOL [Official Music Video] Moneybagg Yo – PLAY DA FOOL [Official Music Video]](https://i.ytimg.com/vi/q5y5HHUwfBs/maxresdefault.jpg)

![Cardi B – Like What (Freestyle) [Official Music Video] Cardi B – Like What (Freestyle) [Official Music Video]](https://i.ytimg.com/vi/GcNC7YnlhKc/maxresdefault.jpg)

![Quando Rondo – Grow Up [Official Music Video] Quando Rondo – Grow Up [Official Music Video]](https://i.ytimg.com/vi/8zFnCg3BO4Q/maxresdefault.jpg)